Calculate Your Monthly Mortgage

Monthly Mortgage Payments

Banks we work with in the UAE

Why Choose us?

- Competitive Rates

- Fast Approvals

- Trusted Advice

- Flexible Options

Our Services

First-Time Homebuyer Mortgages

- Guidance through the entire process.

- Access to special first-time buyer programs and benefits.

- Pre-approval assistance to know your budget.

Investment Property Mortgages

- Financing for rental or commercial properties.

- Flexible solutions for multiple properties.

- Advice on maximizing returns with the right mortgage structure.

Mortgage Refinancing

- Lower your monthly payments by refinancing at better rates.

- Switch from variable to fixed-rate mortgages.

- Access home equity for renovations, education, or investments.

Why Choose Prime Mortgage?

We are about creating an empowering experience for buyers. Here are some reasons why we are the go-to choice:

We offer a digital platform powered by over 500 mortgage products from all the banks, ensuring you find the perfect fit.

With more than 10 years of experience in the property buying sector, our team provides invaluable insights and guidance.

Transparency is key. Enjoy our platform with no additional costs, allowing you to focus on what truly matters—finding your perfect home.

Seamless home loan experience

No fees, no impact on your credit score – just a straightforward assessment. We explore the market with over 20 lenders offering more than 500 mortgage options to find the perfect fit for you.

Your personal case manager handles everything. You can relax and track your application via the Prime Mortgage expert, uploading documents at your convenience.

Our dedicated team takes care of the legwork and liaises with the bank, ensuring a stress-free experience securing your mortgage.

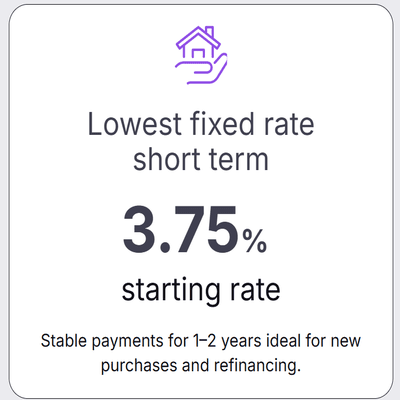

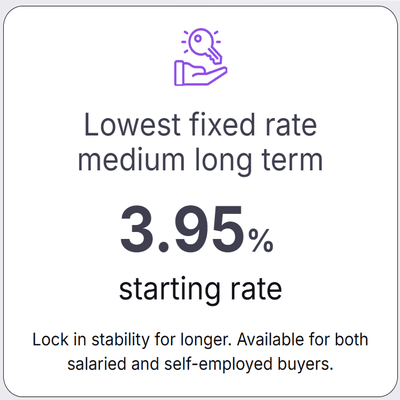

* Rates subject to terms, conditions, and eligibility.

Frequently Asked Question

What is the minimum deposit for a mortgage in the UAE?

As an expat, you’ll need a minimum deposit of 20% for properties valued under AED 5 million. If the property costs more, the deposit increases to 30%. For UAE nationals, the minimum starts at 15%.

What is the minimum salary for a mortgage loan in the UAE?

Most banks require expats to have a minimum monthly salary of AED 15,000 to qualify for a mortgage. However, some lenders may work with slightly lower incomes depending on your overall financial situation and loan amount.

What is the interest rate for a home loan in Dubai?

Interest rates depend on the mortgage type and market conditions:

– Fixed-Rate Mortgages: Rates usually range between 3% to 5% per year, offering stability for a set period (e.g., 1–5 years).

– Variable-Rate Mortgages: These are tied to the Emirates Interbank Offered Rate (EIBOR) and may rise or fall over time based on market trends.

Is it difficult to get a mortgage in Dubai?

Getting a mortgage in Dubai is easier with the right support. At Prime Mortgage, we start with a quick, free eligibility check that won’t impact your credit score. Your personal case manager then handles everything while you track progress and upload documents. We take care of the rest, ensuring a smooth and stress-free approval process.

As a first-time homebuyer in Dubai, I was overwhelmed with the process. The mortgage team guided me step by step, explained every option clearly, and secured the best rate possible. Their professionalism and patience made the entire journey stress-free. I couldn’t have asked for a smoother experience.

I was looking for a reliable mortgage solution for my investment property in Abu Dhabi. The broker not only found me competitive rates but also helped with the documentation and bank approvals faster than I expected. Their expertise in the UAE market gave me complete confidence in my decision.

Being an expat, I thought getting a mortgage in the UAE would be complicated. But the team made it effortless — from comparing banks to negotiating the terms, everything was handled professionally. I’m now the proud owner of my dream villa in Sharjah, thanks to their support."

What impressed me the most was the speed and transparency. Within days, my mortgage was pre-approved and I had clarity on all costs involved. No hidden surprises, just honest guidance and exceptional service. Highly recommend their brokerage to anyone looking for hassle-free financing in the UAE.